This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Brands & Merch CMU Trends Labels & Publishers

Trends: The ads sector in focus – Five take-aways from Resilient Music’s research

By Chris Cooke | Published on Sunday 27 September 2015

Music rights procurement consultancy Resilient Music recently put the spotlight on the advertising and branded content side of sync, surveying brands, ad agencies, rights owners and artist managers about the way licensees and licensors work together, how each side views the sync sector, and where the opportunities to do better business lie.

The results of that survey are being published through a series of blogs on Resilient’s own website. But CMU got a sneak preview, and here we present our five key take-aways from the research.

1. Music remains a key tool for consumer engagement

A good starting point for the music rights industry, Resilient’s respondents on the brand and agency side generally agreed that music continues to play an important role in advertising and branded content activity.

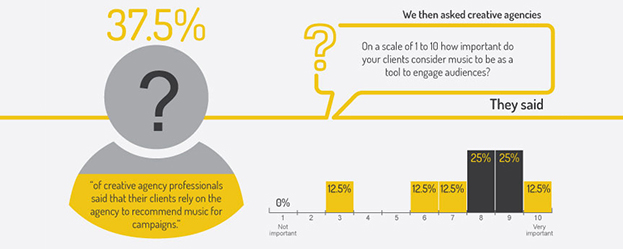

Creative agencies were asked to rank how important music was to their clients on a scale of one to ten: 12.5% of respondents went with ten, while a further 50% went with eight or nine. Meanwhile respondents added that “music is the priority for engagement”, that it “is a central part of all our branded communications”, and that the right music “keeps the brand authentic and gives it an additional layer of emotive creative”.

As Resilient notes, results like this will add to the demands often made by music rights owners that brands should allocate bigger budgets to the music components of their campaigns. Though any one brand’s spending on music will always depend to an extent on how flexible they are on which specific songs and recordings they use, because flexibility on that front will always strengthen the negotiating hand of the brand when the sync deal is done.

2. Brands and rights owners could be involved earlier in the creative process

Resilient says that brands often complain that their creative agencies come to the table relatively late in the day with a single-track recommendation for the adverts that they have been developing. Aside from the brand possibly wanting to be involved in the final music selection process, this also weakens their negotiating hand on the licensing side, because the rights owner can exploit both the fact that the brand has few alternatives and that it needs the deal to be done quickly.

Some of those agencies Resilient surveyed admitted that they tended to present clients with single track options relatively late in the day, though explained that this was, in part, because final music selection was influenced by the creative process itself; one agency noted that it would use a placeholder track earlier on in the process to communicate the mood of the commercial, but would likely make a final recommendation on what music to use much later in the creative process, once other elements of the campaign were in place.

Though other agencies insisted that – while their creatives might have a preference – they would normally provide clients with two or three alternatives on the music front, and that conversations about musical direction could sometimes start much earlier in the creative process, though even then actual decisions on tracks were unlikely until the editing stage.

Either way, there is probably room for improvement here. As Resilient states: “The advertising trade press frequently talk about brands’ increasing desire for a collaborative approach to campaign creation. With this in mind, a collaborative approach to music selection would be helpful; with a move away from the single track recommendation – typical of an ‘agency knows best’ mind set – to one in which the brand is exposed to a range of music options and is actively involved in setting the musical direction”.

As mentioned above, to some extent it is in the rights holders’ interest for creative agencies to give their clients limited musical options relatively late in the day, because it often enables labels and publishers to negotiate higher fees.

Though some rights holders would also like to be involved in the creative process earlier, especially if working with newer talent and new music, even though doing so might ultimately reduce the fees the label or publisher commands.

One publisher told Resilient: “I think there should be much more communication. Music is integral to a campaign and should never be an afterthought. Bringing in a publisher or label to advise in the early stages of the creative not only ensures extra care for a campaign, but the fees are often a lot better if the artist feels they have invested in the project”.

3. Re-records are a fact of life and can be good for publishers

It’s no secret that in sync, publishers ultimately have a stronger negotiating hand than labels, because a licensee can always commission a new recording of the song that they have set their heart on, providing the publisher would allow such a thing. And of all the strands of the sync sector, advertisers are probably most likely to commission a re-record.

Labels would obviously prefer the original or more famous recordings that they control to be used, but, as one of the record companies Resilient spoke to said, “there’s not much we can do” if a brand decides to go the re-record route and the relevant publishers green light that proposal.

Many on the publishing side are very open to re-records, not least because it provides the licensee with a little more flexibility budget wise which can result in a higher fee for publisher and songwriter. Or, at least, songs a licensee could never afford if both publishing and master rights had to be licensed might now be a viable option. Though there may still be creative considerations about the new recording and how it represents the song.

As for the labels, will they come down on the price for master rights when the ‘re-record’ word is mentioned? Some of Resilient’s respondents insisted “no”. “We won’t be threatened into agreeing to a low fee because the client is considering an inferior re-record”, said one. “We are as competitive as we can be when negotiating, but by the same token we cannot undervalue classic recordings”, said another.

Though some, especially smaller labels did seem to be more flexible on fees if re-records were an option, while some said that they might offer to work with the brand on the re-record itself to secure some business.

4. Fees are going up for online video

Resilient notes that “our experience has been that sync fees for online video have dramatically risen in the past few years, especially for bought online media. The music publishers seem to be leading the charge, especially one of the majors”. And the research seems to back that observation up, ie as online video consumption increases so do the sync fees rights owners demand, though some said that TV advertising would still always attract a premium charge.

Meanwhile, others noted that the fees labels and publishers demand varies according to the kind of online video, and where the videos will be streamed, and that licensees should be clear on this to secure the best deal. Said one: “If it’s YouTube only, it’s a lot less expensive than bought online media. Clients need to be clear about this when asking for rights, and geo-blocking is becoming increasingly important, especially where a brand is a multinational global brand even if they say it’s UK focussed only”.

5. Brands want simpler licensing, obviously

It’s no surprise at all that brands would like music licensing to be simpler – every licensee of music would like the process to be simpler – though it’s always interesting to consider specific gripes, and whether labels, publishers and/or collecting societies could actually address those issues.

The music rights industry knows it should be better at licensing – and that revenue is currently lost to the overly complex system – but at the same time licensees just requesting global combined-rights fixed-rate blanket licenses, as they are prone to do, isn’t going to result in any quick fix. Although some frustrations simply come down to attitude, licensees don’t always feel like they are being treated as a customer, when that’s clearly what they are.

But, as Reslient writes, some of this is down to balance of power. “Our brand clients often complain that some music rights owners don’t behave like their other service providers; ie they don’t fully embrace that they’re a supplier serving their customer in return for a fee. Of course rights owners have a monopolistic position in relation to their assets; if a brand wants to license a particular song, it can only be licensed from the particular music publisher who owns it. And this fact changes the dynamic in the buyer/seller relationship”.

While that dynamic may enable rights owners to be more demanding in the deal making, with so much effort now being put into sync within the music business, perhaps labels and publishers could be putting more resource into client management, so brands do still ultimately feel like valued customers. Some already are, of course, and maybe they’re gaining competitive advantage as a result.

INFO: The infographic at the top of this article come from a much bigger infographic published by Resilient and available here. You can read Resilient’s own analysis of its research here.